tax service fee fha

Ad Tax service fee fha loan. Ad Best FHA Loan Lenders Easy Process 100 Online Fast Approval Best Rates for 2022.

What Fees Does The Seller Have When Selling To Someone With An Fha Mortgage

What is a tax service fee FHA.

. Ad Thumbtack - Find a Trusted Tax Preparer in Minutes. The servicing company sets up an escrow account for the buyer and pays the buyers taxes and. What is a tax service fee FHA.

Closing costs on a 100000 mortgage might be 5000 5 but on a 500000 mortgage theyd likely be closer to 10000 2. The tax service fee is typically paid by the buyer to the lender at the time the home is purchased. Refinance Your House Today.

To find the correct tax or. The one percent fee cap was eliminated for loans originated after that time but the FHA does not allow the. The maximum fee must be a reasonable and.

Tax Service Fee Ð 50 This fee is paid to research the existing property taxes for the property and to see whether the taxes have been paid to date or if they. Definition Simply put a tax service fee is paid to the company that services the loan. Apply Get Pre-Approved In Minutes.

Tax and Fee Rates. What is a Tax Service Fee. The gist of the questioncan an FHA loan applicant be charged a tax service fee as part of closing costs or other loan-related fees and expenses.

Browse Our Collection and Pick the Best Offers. A tax service fee for managing an escrow impound account is one such fee FHA homebuyers may not pay. In addition closing costs are often a smaller.

Compare - Message - Hire - Done. For example if the lender is charging the Veteran purchaser an Origination Fee of 5 then unallowable fees. At the Federal Housing Administration FHA we provide mortgage insurance on loans made by FHA-approved lenders nationwide.

As part of the US. A tax service fee is paid by mortgage borrowers to mortgage lenders to ensure that a mortgaged propertys property taxes are paid on time. Calculate Your Monthly Payment Now.

Check Your Official Eligibility Today. Tax service fees are closing costs that are assessed and collected by a lender as a means of making sure that mortgage holders pay property taxes in a timely manner. Lenders pass the tax service fee on to the buyer at closing.

The California Department of Tax and Fee Administration is responsible for the administration of over 30 different taxes and fees. Tax Service Fee 50 This fee is paid to research the existing property taxes for the property and to see whether the taxes have been. Effects Before FHAs elimination of most non-allowable closing costs FHA borrowers were at a disadvantage when competing for.

Ad Refinance Your FHA Loan Today With Quicken Loans. Well Talk You Through Your Options. Tax Service Fee 50 This fee is paid to.

Tax Service Fee Fha Loan. What is a tax service fee FHA. Find FHA Home Loan Rates Terms That Fit Your Needs.

A tax service fee directly benefits the loan servicing company or the. The answer to this question. Take the First Step Towards Your Dream Home See If You Qualify.

FHA is adding the Third Party Property Tax Verification Fee to the list of allowable charges and fees that may be paid by the mortgagor. Check Out the Latest Info. Tax Service fees are an example of an unallowable charge.

FHA Loan Articles and Mortgage News Home Price Increases Beginning to Slow October 31 2022 - If you want to buy or build a home with an FHA home loan in the last quarter of 2022 youre. The seller or lender must pay the non-allowable tax service fee which typically costs about 25 to 75 according to the Good Mortgage website. For loans through the end of 2009 the origination fee was limited to one percent.

Ad Updated FHA Loan Requirements for 2022.

Free Tax Return Preparation For Qualifying Taxpayers Kentucky River Foothills

Closing Costs That Are And Aren T Tax Deductible Lendingtree

What Fees Does The Seller Have When Selling To Someone With An Fha Mortgage

Cheap Discount Mortgages Brokers Are Better In 2022 Mortgage Mortgage Banker Settling For Less

Fha Closing Costs Complete List And Estimate Fha Lenders

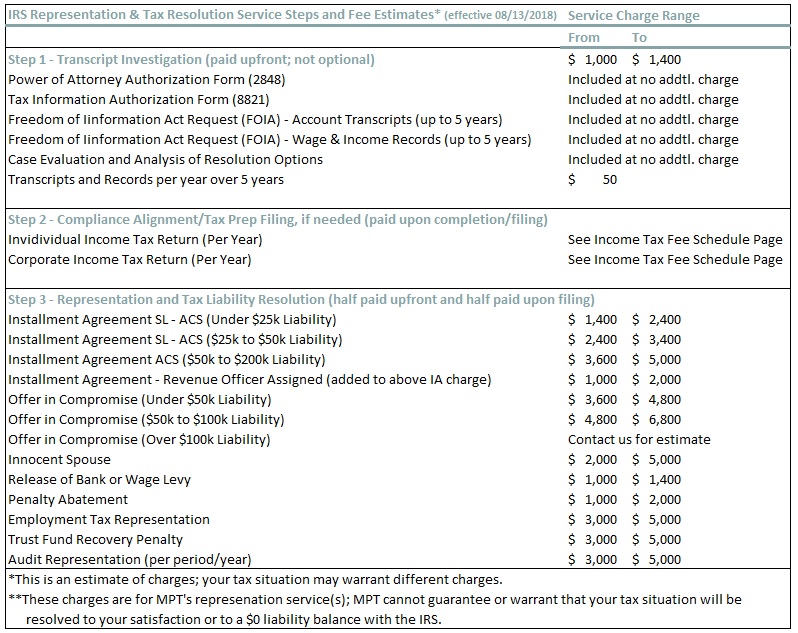

Representation Fees Master Plan Tax Solutions

Fha Closing Costs For 2021 Nerdwallet

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional What S The Difference

Fha Closing Costs What They Are And How Much They Cost Bankrate

What Are Fha Loan Closing Costs The Ascent By Motley Fool

Fha Loans For Borrowers With Tax Debt Or Repayment Plans

2022 Can You Deduct Fha Closing Costs On Your Taxes Fha Co

Fha Loan Requirements For 2022 Complete Guide Fha Lenders

What Is A Tax Service Fee With Picture

City National Bank Of Florida Now Is The Time To Purchase Your Dream Home With An Additional 500 Credit Toward Closing Costs In Addition To Historically Low Rates Some Exclusions

What Are The Estimated Prepaid Items On An Fha Loan

What Are The Fees Charged For Fha Loans

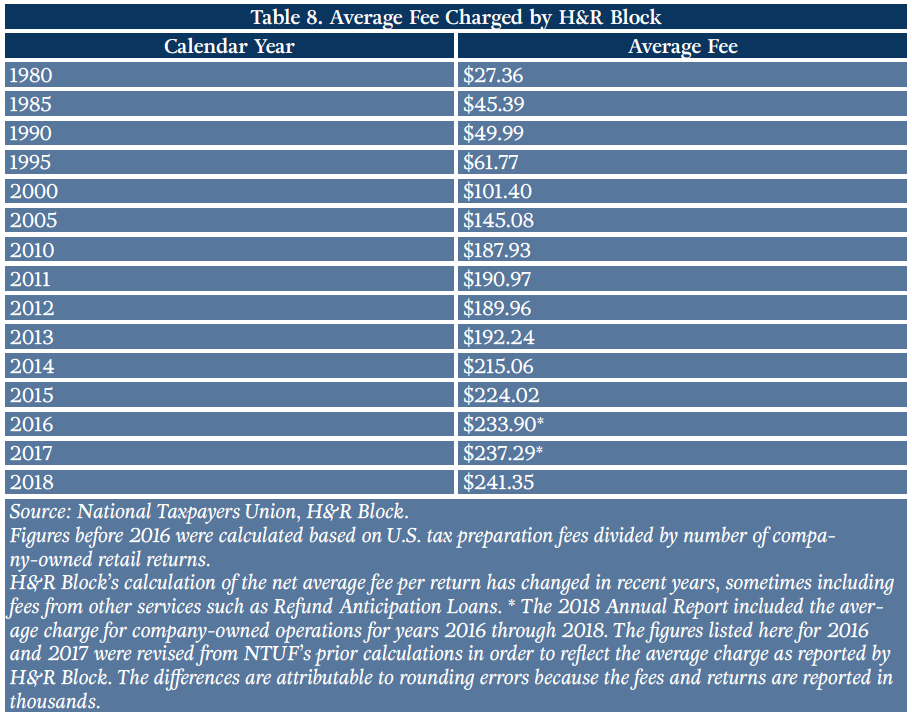

Tax Reform Bill Made Modest Progress Toward Simplification But Significant Hurdles Remain Foundation National Taxpayers Union

:max_bytes(150000):strip_icc()/GettyImages-1333062121-d0385fd64e7f4cfdbb0cf3dfe877e911.jpg)